Here's the breaking news you guys

It used to be, if you wanted to buy and live in a 2-4 unit property, you had to put 15-25% Down.

Why? This was the downpayment required by the Federal mortgage-buying entity: FannieMae (aka the one who buys most of the mortgages handed out from the orginator).

Now, that has been changed to 5% for a Conventional Loan. This is the same as the requirements for a Single-Family home. Basically, in a shockingly positive move, the government is recognizing that homes aren’t affordable. And that buying a 2-4 unit property to offset mortgage costs, is highly desirable and effective for those in the younger generation.

This will be effective November 18th, 2023.

There was always FHA...

It’s true. Most of my “house hack” clients buying a 2-4 unit property to live in and rent out used an FHA Loan. Up to this point of course. This is because FHA allowed for 3.5% Down with fairly loose restrictions on credit score and debt-to-income requirements compared to a Conventional Loan with FannieMae.

However, nobody really loved using an FHA Loan. The main benefit, which still exists, is the opportunity to buy a Multifamily property for 3.5% Down.

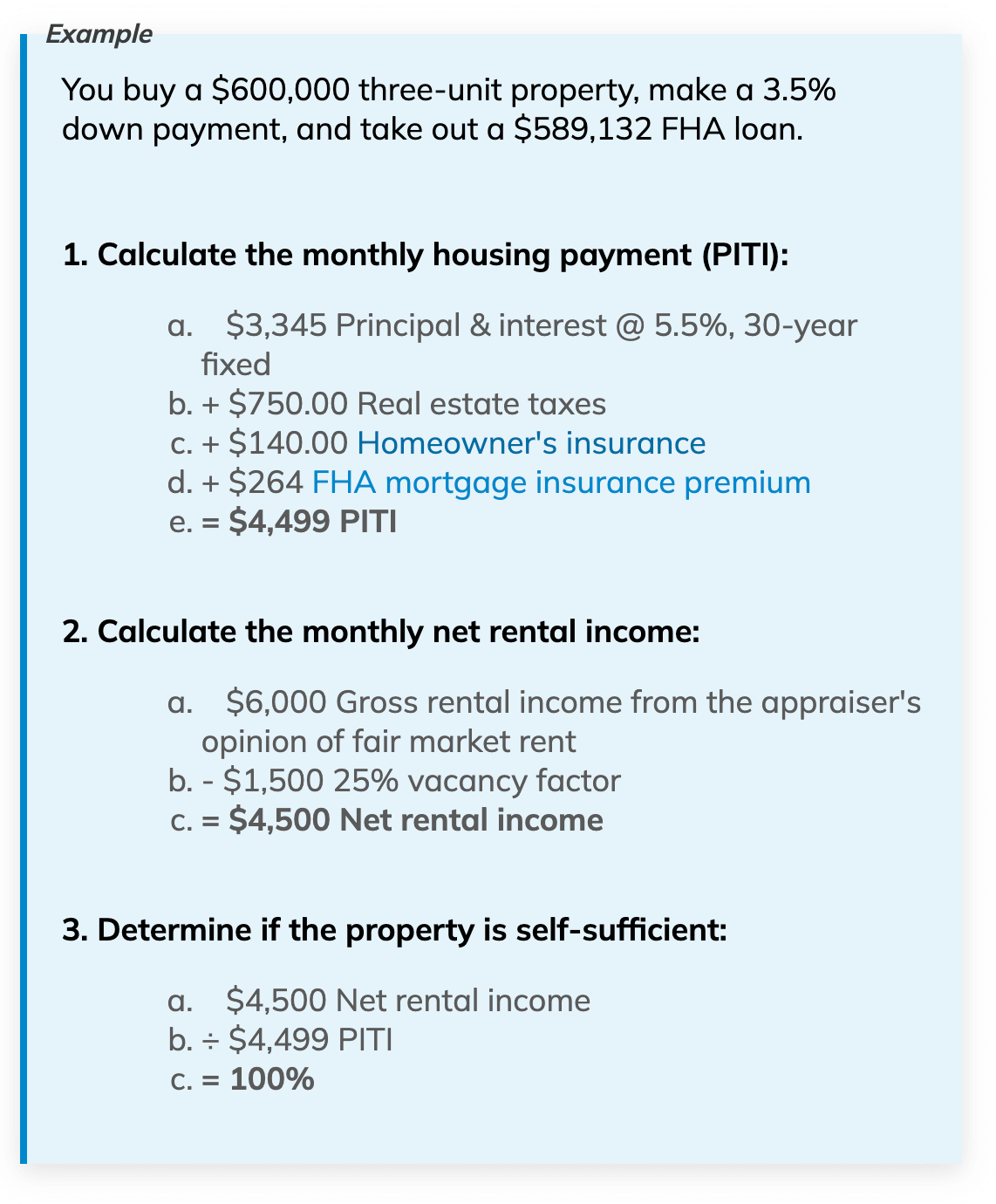

However, with a 3-to-4 unit property, the property had to pass the “Self-Sufficiency test,” which made it more difficult at times.

“Self sufficiency” basically stipulates that the Net Rents (75% of Gross Rents) must cover the entire Mortgage PITI (Principle, Interest, Taxes, Insurance). See the image below for an example:

There is also the (at-times) ridiculous appraisal requirements for an FHA Loan. I can’t tell you how many times I’ve seen a Duplex called out for older paint that had to be scraped, repainted, and all the little chips disposed of, due to lead-based paint concerns. Handrails in the proper spots, etc etc. Lots of little hoops. This was an FHA thing.

Most duplexes in Indy range from $200-350k...

This means that the average person now has to have about $10-17.5k in hand to meet the new FannieMae downpayment requirements at 5% Down.

That is reasonable…

This new policy will open the doors to a lot more people to consider living in a duplex to quad.

What are the ramifications considering all this?

The obvious one is that more people will consider “house hacking” to live in a multifamily for a bit, and then keep it as a rental. It’s a no brainer, especially for someone in their 20s-30s.

But also, since this opens the pool of Multifamily properties to so many new buyers, I see the demand for these properties going off the charts.

Already, we have record-low inventory, which is actually exacerbated in the Multifamily sector. These properties will now Appreciate much more closely to Single-Family homes, and I see them continuing to rise in value.

—

Thanks for reading an following along. If you need help reach out to Roots Realty Co., our team who can get you all set up to buy a Multifamily property. To get started go to this link.